[POM Daily Review] Insufficient Fundamental Support, Weak Actual Trading Volume

1. Today's Summary

①、 The Hebi Longyu POM unit will be shut down for maintenance on October 20, and the startup time is not yet determined. 。

Tianjin Bohua's POM unit is scheduled for shutdown maintenance on July 7, and the restart time is not yet determined.

2 Spot Overview

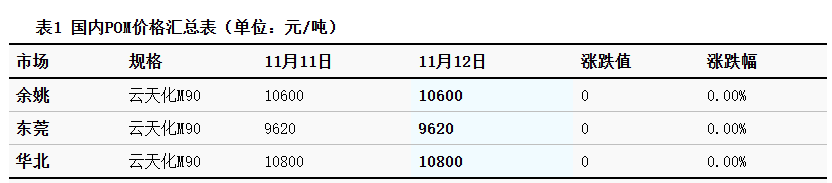

Based on the Yuyao region as a benchmark, the price of Yuntianhua M90 is 10,600 RMB per ton today, remaining stable compared to the previous period. Today's POM market is consolidating sideways. The fundamental support is limited, the inventory pressure of petrochemical plants is gradually increasing, and the market trend remains weak. Some offers are struggling to close deals, with traders having a maneuvering space of 100-200 yuan/ton. By the close, the tax-included price of domestic POM in the Yuyao market was 8,100-11,100 yuan/ton, and the cash price in the Dongguan market was 7,300-10,400 yuan/ton.

|

Figure 1 Domestic POM Price Trend Chart for 2024-2025 (Yuan/Ton) |

Figure 2 Price Trend Chart of Domestic POM in Various Regions for 2024-2025 (Yuan/Ton) |

|

|

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

This week, the domestic POM capacity utilization rate is at 78.73%, an increase of 2.61% compared to last week. The Kaifeng Longyu POM plant has resumed full-load production, and the Yankuang Luhua Phase II POM plant... Hebi Longyu The Tianjin Bohua POM unit is currently shut down for maintenance. This week's maintenance loss has decreased. This week's POM production cost adjustment. The gross profit margin of the product continues to rise, increasing the profit space by 11 yuan per ton.

|

Figure 3: Trend Chart of Domestic POM Capacity Utilization Rate for 2024-2025 |

Figure 4: Comparison of Domestic POM Profit and Price for 2024-2025 (Yuan/Ton) |

![[POM日评]:订单表现低迷 购销气氛清淡(20251110)](https://oss.plastmatch.com/zx/image/3b82f2dd6b3a446db771f12846d7313c.png) |

![[POM日评]:订单表现低迷 购销气氛清淡(20251110)](https://oss.plastmatch.com/zx/image/b68523f147724ea6a78119e462e08c74.png)

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

4. Price Prediction

The spot market is under pressure, and the inventory pressure for petrochemical plants has increased. The short-term fundamental outlook lacks positive guidance, leading to an overall poor trading sentiment among operators. Some offers continue to negotiate for sales, with a price range of 100-200 yuan/ton. However, given that current prices are close to the edge of the cost line, the room for discounts is relatively limited. End users are mainly in a wait-and-see mindset, resulting in sporadic transactions. Longzhong expects that the domestic POM market will remain stable with slight fluctuations in the short term.

5 Related product information:

Methanol:Today's methanol spot price index is 2053.44, up by 1.42. The spot price in Taicang is 2072, up by 12, while the price in the North Line of Inner Mongolia is 2007.5, unchanged. According to Longzhong's monitoring of prices in 20 large and medium-sized cities, eight cities have seen varying degrees of increase, with the rise ranging from 5 to 18 yuan/ton. Today, the domestic methanol market continues to show regional characteristics. The spot prices in coastal areas have slightly increased following the market trend, but the accumulation of inventory remains at historically high levels, restricting the market. Near-term buying is mostly on-demand, leading to a stalemate between buyers and sellers, with a generally moderate atmosphere. The inland market is operating steadily to slightly weaker. In the southwest, due to weak supply and demand dynamics, the focus of some local transactions continues to shift downward. In the northwest production area, the market is weak and stable, mainly digesting contracts, with some enterprises experiencing auction failures in the afternoon. In the short term, risks such as sufficient supply, cautious demand, insufficient active buying, and limited following of price increases still persist. It is essential to continue monitoring the transmission of market fluctuations.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: 10,000 tons)

|

Data |

Publication Date |

Last period data |

Current Trend Forecast |

|

Capacity utilization |

Thursday 17:00 |

78.73% |

↗ |

|

Production Profit Margin |

Thursday 17:00 |

2.35% |

↗ |

|

Data source: Longzhong Information Remarks: 1. Consider ↓↑ as significant fluctuations, highlighting data dimensions with a change exceeding 3%. 2. View ↗↘ as narrow fluctuations, highlighting data with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

Progress on plastic reduction in packaging released by 16 fast-moving consumer goods brands including nestlé, pepsi, unilever, coca-cola, and mars

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

By 2030, Norway's New Sorting Facilities Will Process About 80% Of The Country's Plastic Packaging Waste

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

![[POM日评]:订单表现低迷 购销气氛清淡(20251110)](https://oss.plastmatch.com/zx/image/18354909385d4210ade98475aac472d7.png)

![[POM日评]:订单表现低迷 购销气氛清淡(20251110)](https://oss.plastmatch.com/zx/image/68c5b65aecc94c409e838b2fad3b06e9.png)