October 2025 Top 30 SUV Sales and Complaints Review

According to the national automobile production and sales data provided by the China Passenger Car Association, the cumulative retail sales of the domestic SUV market in October 2025 reached 1.143 million units, representing a month-on-month increase of 1.1% and a year-on-year increase of 0.9%. During the same period, Car Quality Network received 6,956 valid complaints from car owners regarding SUVs, showing a month-on-month decrease of 2.8% and a year-on-year increase of 34.8%. After removing information voluntarily withdrawn by complainants, the ranking of the TOP30 SUV sales complaints for October 2025 is as follows:

Sales share of American and German brands declines, while mid-to-large SUVs lead in sales.

In October, the retail sales of SUVs in the domestic market once again exceeded one million units, maintaining a trend of month-on-month growth, but the increase has. Specifically, 60% of the models on the list saw an increase in sales compared to the previous month, a slight decrease compared to September. The AITO M7, which underwent a product refresh at the beginning of September, performed remarkably, with a month-on-month sales increase of 169.2%, setting the highest monthly sales record of the year. Equally impressive is the Fangcheng Leopard Titanium 7, which has been on the market for just over two months, surpassing 20,000 units in sales and achieving a doubling in growth. In contrast, models that saw a decline in sales included the Tesla Model Y, which suffered a "halving" of sales, dropping 61.9% compared to September. Additionally, the sales of the BYD Yuan UP also saw a noticeable decline this month, with a month-on-month drop of 23.6%.

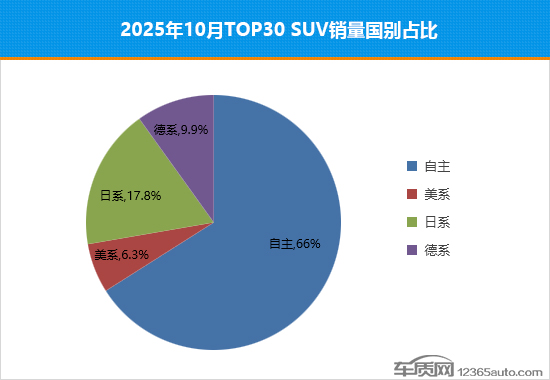

This month, the market share of domestic brands has reached a breakthrough, achieving the highest point of the year, with a month-on-month increase of 7 percentage points, exceeding 60% of the total. It is noteworthy that the market share of American and German brands has declined, both falling to single digits. In particular, the former has decreased by 6.1 percentage points compared to September.

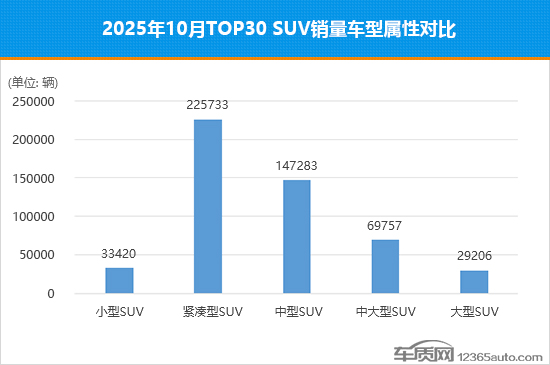

In October, the sales of mid-to-large SUVs experienced a surge, with a month-on-month increase of over 100%, creating the highest record in nearly a year. During the same period, the sales of large SUVs also grew, rising by 37.5% compared to September. Apart from these, the sales of other models saw varying degrees of decline, with mid-sized SUVs experiencing the largest drop, decreasing by 19.1% compared to the previous month.

The proportion of quality issues continues to rise, with "driving assistance system failures" becoming a new hotspot for complaints.

From the changes in the complaint volume on this month's list, it can be seen that half of the models have experienced a month-on-month decline in complaint volume. Among them, the largest decrease is observed in the Geely Boyue L, with a month-on-month decline of 55.6%, bringing the complaint volume back to double digits. Additionally, the complaint volumes for Haval Big Dog and Geely Galaxy E5 have also decreased significantly, with declines of 50% and 46.2% compared to September, respectively, indicating an improvement in reputation. During the same period, the number of models with a month-on-month increase in complaint volume has significantly risen compared to last month, with GAC Toyota Wildlander showing the highest growth rate, with complaint volume rising to double digits. Apart from this, there are several other models that have also seen significant increases in complaint volume, such as BYD Song Pro New Energy and Geely Binrui.

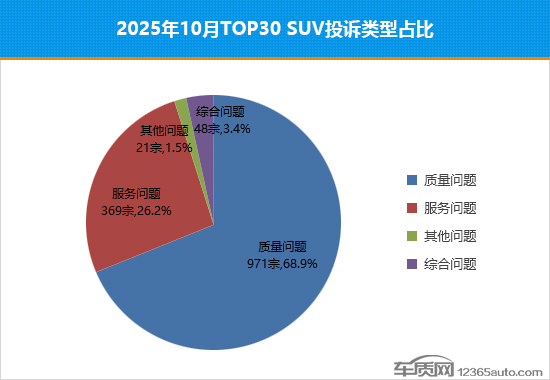

In October, although the number of complaints about quality issues slightly decreased compared to the previous month, the proportion of complaints further expanded, increasing by 4.4 percentage points compared to September. From the perspective of complaint fault points, "transmission computer board failure" remains the most complained about fault point, with the number of complaints increasing by 40.4% month-on-month. It is noteworthy that this month, complaints about "driving assistance system failures" increased by 33.9% compared to the previous month, rising to the 5th position, with many complaints coming from models of some emerging brands.

The complaint-to-sales ratio of the 2023 model performs better than the same class.

According to the complaint-to-sales ratio statistics rules of Chezhuwang, the complaint volume for a model includes all valid complaints for the month (including information where the complainant voluntarily withdraws the complaint due to satisfactory resolution). Statistics show that the average complaint-to-sales ratio for SUVs in October is 37.4 per ten thousand, slightly higher than September's 36.8, indicating a trend of increasing stability overall.

In terms of the rankings, a total of 23 models have a complaint-to-sales ratio lower than the average for SUVs in October. Among them, eight models showed a decrease in this ratio compared to the previous month, the majority of which are domestic brands, reflecting an improvement over September.

Key Model Analysis

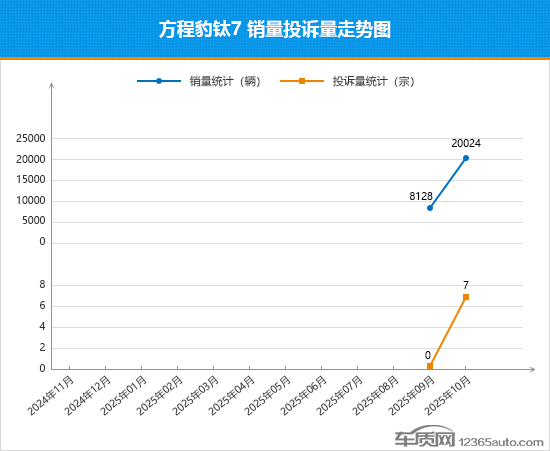

1. Sales surge, and the Titanium 7 is expected to break through higher sales ceilings.

As the second model in the Titanium series under Equation Leopard, the Titanium 7, positioned as a plug-in hybrid mid-to-large SUV, has garnered significant attention. Unlike the lukewarm reception of the Titanium 3, the Titanium 7 showed "blockbuster" potential as soon as it was launched, with sales surging by over 1.4 times month-on-month in October, surpassing the 20,000 mark, and claiming the runner-up position in the domestic mid-to-large SUV market monthly sales. The primary reason for this is its affordable price, coupled with its spacious practicality, new intelligent ecosystem, reliable safety quality, and robust performance, which are enough to attract many family users. While sales have soared, the Titanium 7 has bid farewell to "zero complaints," its monthly complaint volume remains at a reasonable level, mostly concerning service issues, particularly in the pre-sales stage. From its complaint-to-sales ratio in October, it remains in single digits, ranking among the top models on the list, which is commendable. With the successive delivery of high-end color models in Frost Gray and Green Ridge, the Titanium 7's product lineup will be more complete, likely further stimulating market enthusiasm and boosting sales to break through the current ceiling, continuing the "blockbuster" momentum.

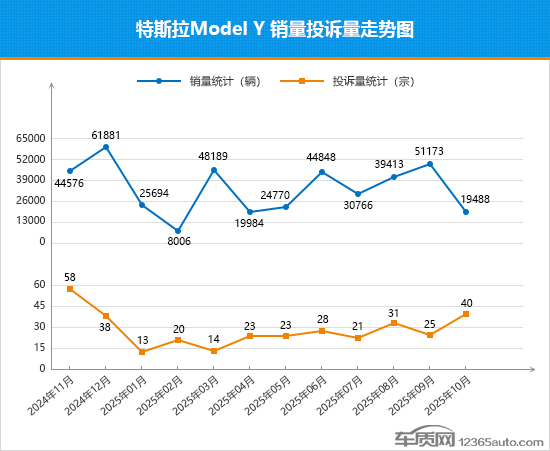

2. Complaints and Sales Ratio Shows Decline, Tesla Model Y Faces Reputation Crisis

In 2025, the market performance of the Tesla Model Y can be described as "a tale of two extremes," with monthly sales fluctuating frequently between peaks and declines. In September, its monthly sales hit a record high for the year, but in the following month of October, it suffered a "Waterloo," with monthly sales plummeting by more than 60% month-on-month, dropping to the second-lowest point of the year. In the first 10 months of this year, Tesla Model Y's cumulative sales reached 312,331 units, down 16.5% compared to the same period last year, marking the lowest historical value for the same period in nearly four years. Compared to the ups and downs of sales, the monthly complaint volume has been showing an upward trend since January, with October reaching the highest point of the year, increasing by 60% month-on-month, and its reputation starting to decline. According to data from CheZhiWang, over 90% of the complaints about the Tesla Model Y are related to quality issues, primarily focused on body accessories and electrical equipment. Among them, "seat malfunctions" are relatively common. Some owners have reported that the passenger seat headrest tends to "leak oil" after exposure to the sun, which cannot be cleaned and severely affects daily use. Considering the complaint-to-sales ratio in October, it shows a significant increase compared to September, rising to double digits, indicating a noticeable deterioration in performance. Given the current situation of declining sales and rising complaints, the market performance of the Tesla Model Y is expected to continue experiencing volatility. If the reputation issues are not resolved, stabilizing short-term sales may be difficult.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

At Least 44 Dead in Century-Old Fire! Questioning Hong Kong's Hong Fu Garden: Why Has the Path to Fire Resistance Taken 15 Years Without Progress?

-

Satellite chemical's profits surge! can the 26.6 billion yuan high-end new materials project meet expectations? a review of progress on four major projects

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Estun Turns Profitable in 2025 Half-Year Report, Industrial Robot Shipments Rank First Among Domestic Brands

-

Avatr Files for IPO on HKEX, Plans to Complete Listing in Q2 2026