[eva daily review] market transactions encounter obstacles, transaction focus steadily declines

1 Today's Summary

①. The ex-factory price of EVA petrochemicals remained stable this week.

This week's EVA petrochemical units: Zhejiang Petrochemical and Ningbo Formosa are shut down for maintenance; Yanshan Petrochemical's unit has been idle for a long time, and the others are in stable production. Hanwha-GS Energy in Korea with a capacity of 300,000 tons per year.September 25thDevice commissioning.

2. Spot Overview

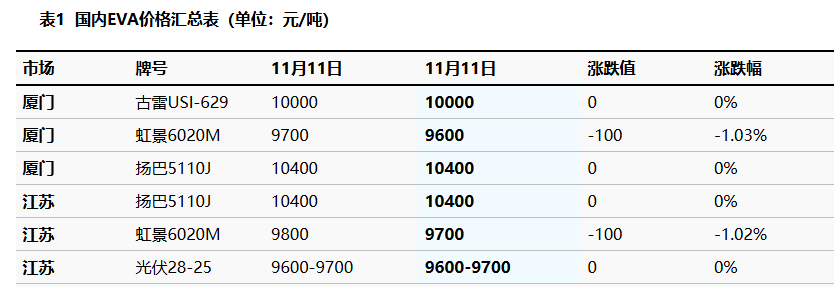

Today's domestic EVA market offers are stable to slightly lower.Recently, market transactions have been sluggish, and downstream end factories...The willingness to receive goods is low, and the pressure on holders to sell is gradually increasing, coupled with the decline in auction prices. Today's market offers are steadily decreasing, with transactions centered around real-time negotiations. Mainstream prices: Soft material reference 9600-10200 yuan/ton, hard material reference 9800-10300 yuan/ton. 。

|

Figure 1 Domestic EVA Price Trend (Yuan/Ton) |

Figure 2 Domestic EVA Price Trend Chart by Category (Yuan/Ton) |

![[EVA日评]:需求不振信心不足 市场弱稳整理(20251107)](https://oss.plastmatch.com/zx/image/4d1c2f7014e040b79ef85b8d02f232a6.png) |

![[EVA日评]:需求不振信心不足 市场弱稳整理(20251107)](https://oss.plastmatch.com/zx/image/8aec771bbf774751a284347fdeb85870.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Status

The domestic EVA petrochemical plants: Sinochem Quanzhou produces FL00628; Jiangsu Sailboat's tubular facility produces photovoltaic, while the kettle-type produces UE28400; Jiangsu Hongjing's PV1 line produces photovoltaic, and the PV2 line.Produce PV V2825PV3 line produces 6020M; Ningxia Baofeng produces hard material 1803; Yanchang Yulin produces 6020M; Tianli Gaoxin produces hard material 1803; Zhejiang Petrochemical is shut down for maintenance; Gulei Petrochemical produces USI-629.All three EVA units at Yanshan have been shut down.In addition, the price of soft materials in the South China market is 9,700-10,200 yuan/ton, and the gross profit margin of the domestic EVA industry is around 1,300 yuan/ton.

|

Figure 3: Trend Chart of Domestic EVA Capacity Utilization Rate |

Figure 4: Comparison of Domestic EVA Profit and Price (CNY/ton) |

![[EVA日评]:需求不振信心不足 市场弱稳整理(20251107)](https://oss.plastmatch.com/zx/image/288fafe2436c4f79a5442755dccac30f.png) |

![[EVA日评]:需求不振信心不足 市场弱稳整理(20251107)](https://oss.plastmatch.com/zx/image/9fdf423ca2a14410afcff25b5f282e50.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4 Price Forecast

In the short term, domestic EVA petrochemicalsDue to the increased shutdowns for equipment maintenance, the overall supply is abundant, but certain grades are relatively tight.Overall demand downstream lacks expectations for improvement, and the arrival of imported supplies and the commissioning of new production capacity by the end of the year are both negative factors putting pressure on the market, which lacks substantial positive support. Overall, it is expected that the domestic EVA market will trend towards weak adjustment in the near term. 。

5 ============ Translated: Relevant product situation

1 Ethylene: On November 11, CFR Northeast Asia was at 740 USD/ton, stable, and CFR Southeast Asia was at 730 USD/ton, stable. The ethylene price of Sinopec Chemical Commercial Holding Company Limited East China Branch remains stable at 6200 yuan/ton, and the ethylene price of Jinshan United Trade is synchronized at 6200 yuan/ton.

2 Vinyl acetate The mainstream negotiation price for vinyl acetate in the East China market is 5600-5700 yuan/ton, Jiangsu. Petrochemical prices are between 5600-5700 yuan per ton. The market is chaotic with few actual transactions, and the price focus continues to be on the low end.

6 Data Calendar

Table 2 Domestic EVA Data Overview (Unit: 10,000 tons)

|

Data |

Release Date |

Data |

Current Trend Forecast |

|

EVA Capacity utilization rate |

Thursday 16:00PM |

84.23% |

↓ |

|

EVA Weekly Production |

Thursday 4:00 PM |

5.84 |

↓ |

|

Data Source: Longzhong Information Remark: 1. Significant fluctuations are considered as large swings, highlighting data dimensions with a change in value exceeding 3%. 2. ↗↘ are considered narrow fluctuations, highlighting data with a rise or fall of within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

Progress on plastic reduction in packaging released by 16 fast-moving consumer goods brands including nestlé, pepsi, unilever, coca-cola, and mars

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

By 2030, Norway's New Sorting Facilities Will Process About 80% Of The Country's Plastic Packaging Waste

-

Building Partnerships Through the CIIE: Together on the Path to Win-Win Cooperation